Making a deposit is the initial and fundamental step to kickstart your enjoyment at Aceph, one of the leading online betting platforms in the Philippines. This process is not just the foundation for your gaming activities but also a stepping stone to access the diverse betting services that Aceph offers.

This article aims to provide you with a clear understanding of the Aceph deposit process, guiding you through each step so you can confidently participate in betting activities.

Aceph Deposit Guide to Adds Funds to Your Account

Making a deposit into your Aceph account is a straightforward process designed to be user-friendly and secure. This guide provides a step-by-step walkthrough to help you navigate the procedure with ease.

Step 1: Initiating the login process:

- Begin by visiting the official Aceph website.

- Input your user credentials to sign in. For new users, follow the site’s guidelines to register an account.

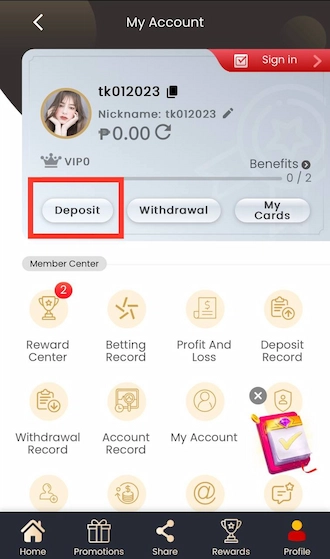

Step 2: Locating the Aceph deposit area:

- After signing in, proceed to the ‘Deposit’ area, usually located in your account dashboard or within the ‘My Account’ section.

- This area presents a variety of options for depositing funds.

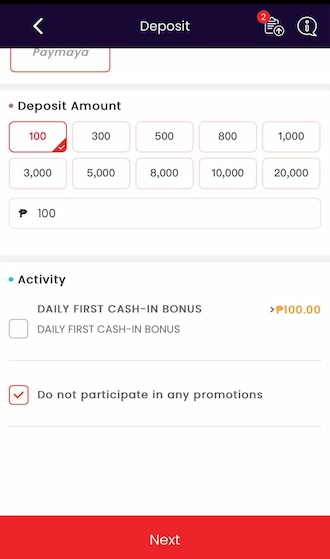

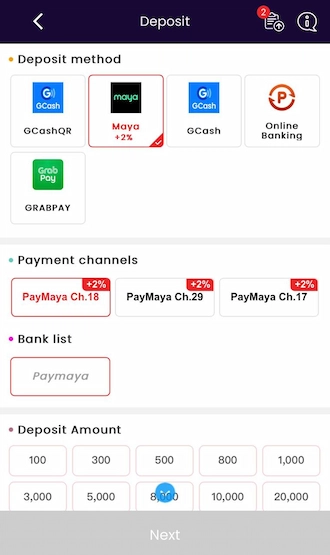

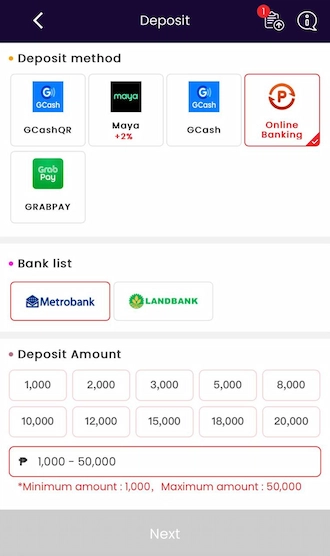

Select 3: Selecting a method:

- Choose a deposit method that aligns with your needs. Options at Aceph include bank transfers, credit/debit cards, and various e-wallets.

- Pay close attention to the specific guidelines associated with each method.

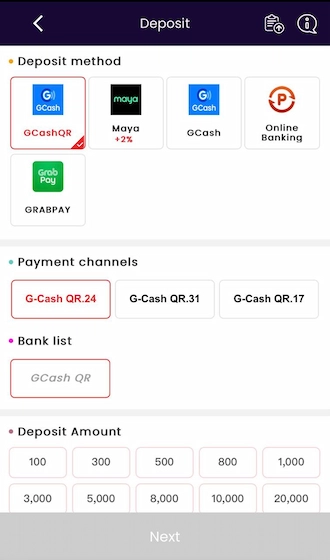

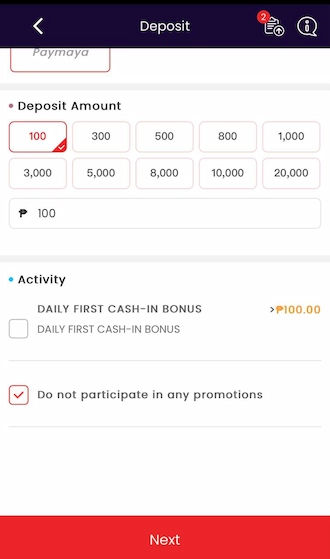

Step 4: Providing information:

- Specify the desired deposit amount, ensuring it meets any set minimums.

- Additional financial details may be necessary for methods like bank transfers or cards.

Step 5: Confirmation of successful deposit at Aceph:

- Upon a successful transaction, expect to receive a notification confirming the deposit.

- Your account balance should now reflect the deposited amount, and you are ready to enjoy the services offered by Aceph.

Remember, it’s crucial to ensure that all provided information is accurate to avoid any delays or issues with your deposit. If you encounter any problems, Aceph’s customer support is available to assist you.

Depositing Funds via Bank Transfer at Aceph

Depositing funds into your Aceph account via bank transfer is a reliable and widely used method. This guide focuses on the supported banks in the Philippines and provides detailed instructions to ensure a smooth transaction process.

Step 1: Philippine bank partners for transfers at Aceph:

- Aceph partners with a variety of prominent Philippine banks to offer safe and efficient bank transfer options. Partners include but are not limited to BDO, BPI, Metrobank, and PNB.

- Confirming your bank’s compatibility with Aceph is crucial for a smooth deposit process.

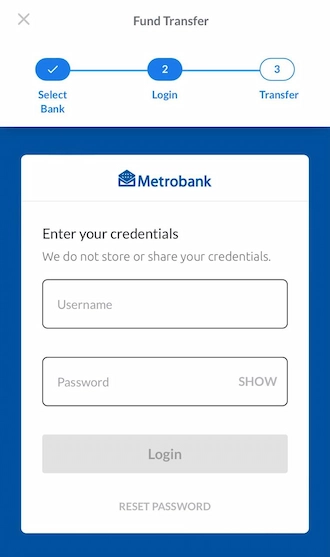

Step 2: Beginning a bank transfer:

- Access your Aceph profile and proceed to the ‘Deposit’ area.

- Opt for ‘Bank Transfer’ as your method of choice for depositing funds.

Step 3: Choosing your financial institution:

- Identify and select your bank from Aceph’s list of affiliated banks.

- Your choice will guide the specific directives and banking information needed for the transaction.

Step 4: Inputting transaction details:

- Input the desired deposit amount, adhering to the minimum set by Aceph.

- Carefully provide your banking details, typically including the account holder’s name, account number, and bank branch.

Step 5: Confirming the deposit details:

- Scrutinize the provided details to avoid errors that could lead to failed transactions.

- Once reviewed, proceed with the request. Aceph will then supply the necessary bank information to complete the transfer.

Step 6: Completing the transfer via your bank:

- Log into your online banking platform or visit your bank branch to initiate the transfer.

- Use the provided Aceph bank details to complete the transaction.

Step 7: Verifying:

- Once the transfer is completed, it may take some time for funds to reflect in your Aceph account, depending on the processing times of the banks involved.

- Keep a copy of the transfer receipt or reference number for any future queries.

Step 8: Deposit confirmation:

- You will receive a notification from Aceph once the deposit is successful.

- Verify your Aceph account balance post-transfer to confirm the deposit at Aceph.

Bank transfers may have processing times and fees depending on your bank’s policies. In case of any discrepancies or issues, contact Aceph’s customer support promptly for assistance.

Depositing Funds Through Gcash at Aceph

Depositing funds into your Aceph account using Gcash is not only convenient but also efficient. This guide details the process, highlighting the benefits of using Gcash, the step-by-step procedure, and important considerations regarding transaction limits and processing time.

Introduction to Gcash and Its Benefits

Gcash, a popular mobile wallet in the Philippines, offers a seamless and secure way to manage funds online. Its integration with Aceph allows for quick deposits, enhancing your gaming experience with ease of use and swift transactions.

The key benefits of using Gcash include its widespread accessibility, user-friendly interface, and the added layer of security for your online transactions.

Read more: Aceph App Download | The Only Official & Verified Link 2025

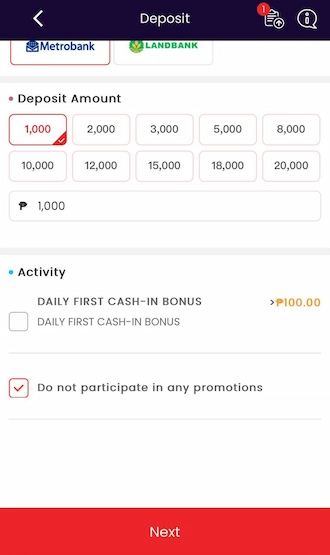

Detailed Steps for Depositing via Gcash

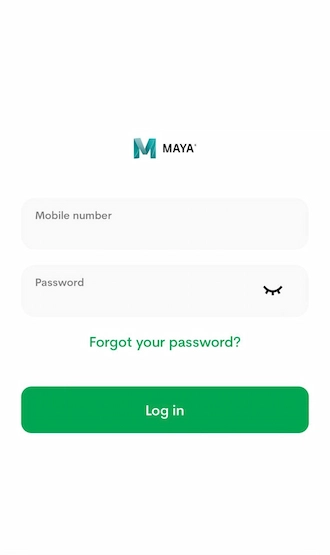

- Log into your Aceph account: Access your Aceph account and navigate to the Aceph deposit section.

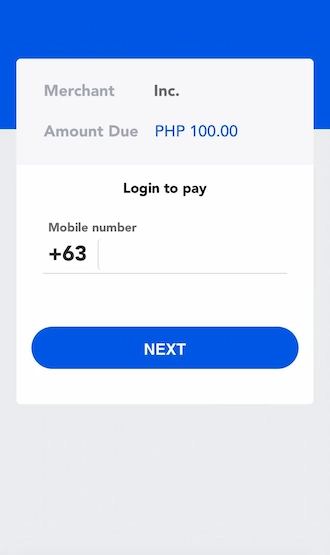

- Selecting Gcash for payments: Within the available payment options, pick Gcash as your preferred method.

- Enter deposit amount: Specify the amount you wish to deposit, adhering to Aceph’s minimum deposit requirements.

- Provide Gcash account details: Enter your Gcash account information, including your mobile number linked to Gcash.

- Confirm and authorize the transaction: Review the details for accuracy and confirm the transaction. You may need to authenticate the transaction via the Gcash app or through an OTP (One-Time Password) sent to your registered mobile number.

Transaction caps and timeframes for processing

- Understanding limits: Be aware of the transaction limits imposed by both Gcash and Aceph. These limits ensure safe and regulated transactions but may vary depending on your account type and usage history.

- Processing time: Deposits via Gcash are typically processed quickly. However, it’s essential to account for potential delays during peak times or system maintenance. Always check for any notifications or updates from Aceph regarding deposit processing times.

In conclusion, using Gcash to deposit funds into your Aceph account is a smart choice because of its convenience and efficiency. Keep in mind the transaction limits and processing times to ensure a smooth and hassle-free gaming experience.

Read more: AcePH Casino FAQs: Quick Answers to Clear the Rumors!

Essential Safety Tips For Aceph Deposit Guide

Ensuring a safe and efficient deposit at Aceph Casino requires adherence to certain safety precautions and an understanding of how to check transaction statuses. This guide is divided into two crucial aspects: safety considerations and transaction status checks.

Safety Considerations During Deposits

- Personal information verification: Always double-check your personal details when making a deposit at Aceph. Accuracy in information like your name, account number, and contact details is crucial to prevent delays or misplacements of funds.

- Awareness of transaction limits: Be aware of any limits set by Aceph. These can vary based on your account type and the deposit method used. Staying within these limits is important for a smooth transaction process.

- Secure Internet connection: Use a secure and private Internet connection while performing transactions. This helps in protecting your financial data from potential cyber threats.

- Confidentiality of account details: Never share your Aceph login credentials or bank details with anyone. Aceph staff will never ask for your password in communications.

- Regular updates and notifications: Enable notifications and regularly update your contact details on Aceph to receive prompt alerts about any account activities.

Monitoring transaction progress

- Transaction history: After completing a deposit, you can check the status in the ‘Transaction History’ section of your Aceph account.

- Understanding status indicators: Learn what different status indicators mean, such as ‘Pending,’ ‘Completed,’ or ‘Failed.’

- Dealing with pending transactions: If a deposit is pending for an unusually long time, check with your bank or payment service provider first to confirm if the transaction has been processed on their end.

- Contacting support for failed transactions: In case of a failed transaction, reach out to Aceph’s customer support with the transaction details for assistance.

- Transaction confirmation: Wait for a confirmation notification from Aceph to ensure your funds have been successfully deposited.

Following these guidelines will help ensure that your deposit at Aceph are both secure and successful.

Troubleshooting Deposit Issues at Aceph

When engaging in online transactions, such as depositing funds at Aceph, users may occasionally encounter various issues. This guide focuses on addressing common deposit-related problems, providing clear solutions to each. The content is divided into four key sections for clarity and ease of understanding.

Incorrect account deposit information

Identifying the issue: This occurs when you enter incorrect bank or e-wallet details during the deposit process.

Immediate actions: Double-check the details entered and compare them with your bank or e-wallet records.

Rectifying the error: If you find a discrepancy, contact Aceph’s customer support immediately. Provide them with the correct information and any relevant transaction details.

Preventive measures: Always take a moment to verify your details before confirming any future transactions.

Delay in reflecting deposit funds

Understanding the delay: Sometimes, there may be a lag between completing the deposit and the funds reflecting in your Aceph account.

Initial steps: Wait for the standard processing time, usually mentioned in the deposit at Aceph section, to pass.

Further action: If the deposit doesn’t reflect post the usual processing time, reach out to Aceph’s support with the transaction details for clarification.

Non-receipt of deposit promotional bonuses

Eligibility check: Ensure that you meet all criteria for the promotional bonus, which might include deposit amount, method, or specific games.

Confirmation of compliance: If you have complied with all conditions but still haven’t received the bonus, document your deposit details.

Contact support: Present your case and evidence to Aceph’s customer service for resolution.

Where to resolve deposit Issues?

Primary Point of Contact: Aceph’s customer support is your go-to for any deposit-related queries or issues.

Modes of Communication: Utilize the various channels provided by Aceph, such as email, live chat, or phone support.

Providing Necessary Information: When reaching out, have all relevant transaction details handy to expedite the resolution process.

Adhering to these guidelines can significantly reduce the occurrence of deposit-related issues and facilitate smoother resolutions.

Conclusion

To sum up, navigating the waters of online deposit at Aceph requires a blend of vigilance and understanding of the process. Mistakes can happen, but they can often be rectified with prompt action and clear communication with customer support. We advise all users to familiarize themselves with the transaction processes and to keep abreast of any updates or changes in Aceph’s policies.

FAQs About Aceph Deposit Guide

1. What should I do if my deposit doesn’t reflect in my AcePH account?

If your deposit doesn’t appear in your AcePH account after the expected processing time, first check your transaction history to confirm the status. Ensure the payment was completed successfully on your bank or e-wallet’s end. If the issue persists, contact AcePH’s customer support with your transaction details, such as the reference number and amount, for assistance.

2. Can I use any bank in the Philippines to deposit funds into AcePH?

AcePH partners with several major Philippine banks, including BDO, BPI, Metrobank, and PNB, for bank transfer deposits. However, not all banks may be supported. To ensure a smooth transaction, verify that your bank is compatible with AcePH by checking the list of partnered banks in the ‘Deposit’ section before initiating a transfer.

3. Are there any fees for depositing funds into my AcePH account?

Deposit fees depend on the payment method and your financial provider’s policies. For instance, bank transfers or Gcash transactions may incur charges based on your bank or e-wallet’s terms. AcePH typically does not charge additional fees, but it’s a good idea to review the deposit guidelines or contact support for clarity.

4. How long does it take for a Gcash deposit to process on AcePH?

Gcash deposits to AcePH are usually processed quickly, often within minutes. However, processing times can vary due to factors like system maintenance or high transaction volumes. If your deposit takes longer than expected, monitor your account and reach out to customer support if needed.

5. What happens if I enter incorrect details during a deposit?

Entering incorrect bank or Gcash details can delay or prevent your deposit from being credited. If you notice an error, immediately contact AcePH’s customer support with the correct information and any transaction receipts. To avoid this, always double-check your details before confirming the deposit at Aceph.